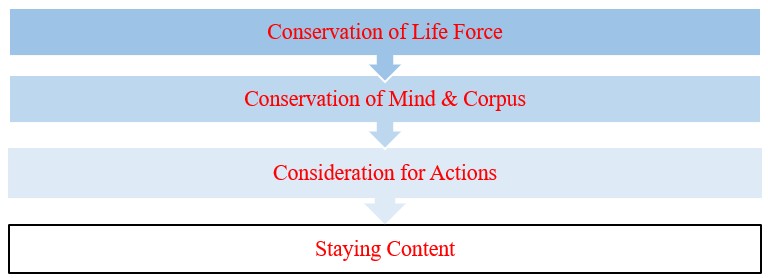

Shree Agyatananda has studied several ancient texts & treaties, to present us with the concept of most important values for humanity. These values maybe adhered to, in all circumstances, for a wholesome life. These are the cores values of humanity and have the capacity to take an individual out of all the problems of life. Practicing of these values is deemed essential for self-awareness & growth. These values are highly linked with each other and are dependent on each other. Though the practice of these values depends on the capabilities of the person who wishes to adhere to them, even practicing them to the best of one’s strength can lead to the perception of immense peace and prosperity. These values are strictly in respect of ones’ own self or can be called as core personal values.

Conservation of Life Force

The life force which we all have inside us, is a mystery. We don’t understand a lot about it. For a simple understanding, we know that all the cells in our bodies, all the organs are alive. In spite of being individually different, they are together and obtain energy & commands from a central force, in our bodies. We even don’t know where this is exactly located inside us. Some say in the brain or spine, but medical sciences have reported even the brain-dead people being alive. For our discussions, it is important just to acknowledge the life inside us and value it as much as we can. This is the top most level of value and practically, all the organisms the world are guided by it.

Every being from mice to human, even the plants & the insects, want to stay alive in the face of loss of life, which we call death. People leave all their life’s belongings and leave their country or society, just to save their life, in the event of external crises. Governments all over the world provide right to life as the most fundamental guarantee to its subjects and violation of this right, that is, taking lives of others is treated as highest crime punishable with the extreme form of punishment, as per their law. Conclusively, it means that life of all beings is important.

Crisis of Life & Conservation

External crises such as wars & calamities, affect the society as a whole and have their origin in the collective form of society, which is always beyond the control of an ordinary individual. However, internal crises, are constructs of human mind, which can also threaten the life force within us or others around us. In the event of such internal crises where people perceive a total failure, it is nothing more than losing their belief in existence and life force. Our utmost priority, at all costs, should be the conservation of this life force inside us and in those whom we can. Religion & spirituality seemingly act as mediums to reach the life force provider within ourselves.

Conservation of Mind & Corpus

The life force within us is staying due to our bodies. The life is the occupant and the corpus or body is its’ abode. We don’t like our own house, if it is dirty, dilapidated or unfit for stay. Similarly, the life force too decides to leave us when the corpus becomes unfit for the life to stay. Just like houses, our bodies & its’ organs are prone to decay, infestations and damages. We therefore take care of our bodies in the ways we can. We take care of our bodies through nutrition, medicines, treatment et cetera. But this would not be possible without knowing about them. So, we also need a mind of our own to store and process the knowledge, decide our actions, reasons & emotions.

Thus, its’ important for us to take care of our mind just like our bodies. The nutrition, medicines & treatment for our mind or intelligence comes in the form of right thoughts, ideas & guidance. Just like wrong medicines damage the organs, wrong ideas damage the intellect of a person. The crux is, taking care of our mental & physical health is the next most important value for us and all of us must conserve them to the best of our levels. We will be discussing its’ importance ahead. Conclusively, the utmost purpose of physical wealth is conservation of our mental & physical health.

Consideration for actions

We know our life is important & so for our lives to sustain, we need to have physical & mental wellness. But that is not free of cost. For this we need to take actions. We learn about things, we earn our livelihoods & accumulate wealth through some ventures, we undertake exercises in different forms, we make friends & relationships and we encounter & emit various thoughts and actions. In totality, we need to keep doing things for better chances at survival. We eat, get education, learning and perform various tasks and cross ourselves with various thoughts & ideas, all our lives. For those who cannot, someone else must do things for them, else they won’t survive. However, there is one issue. We don’t know the results of our actions beforehand but assume the probabilities as per our intellect.

Karma as Actions

In Sanskrit grammar, karma is a basic verb, denoting actions or deeds. Western world refers Karma as some kind of fate dependent upon your actions. And, this is truer than anything else. The outcomes handed to us by Karma, are only on account of our actions. We are just too oblivious to know this. We just calculate the probabilities in our favor or in favor of the outcome we desire. All our actions, whether physical or mental, must be duly considered. Not knowingly, but unknowingly too. Our brains are very fast in processing things. We just don’t know it consciously. Remember a dream and recall how alive and real your dream was and how you felt the real pain or pleasure in the dream without even being present. All the sensations your body felt was real, but it was a purely virtual mental experience.

The point is, having consideration for actions is not difficult and our minds can subconsciously process much more than we assume. But for this, the most important thing is having a crystal clarity in deciding actions, without distortions, which is only possible if we value the consideration for our actions beforehand. Conclusively, all our wishes, desires are medium of actions and thereby affect our Karma. Though we don’t know the outcomes, we know our actions, and we can contemplate our actions before handing it over to our karma for judgment.

Staying Content

Last, but not the least, is accepting things and outcomes. They can be as we wanted or can be differently. The outcomes handed by the Karma, leads to new actions. Actions that you do post acceptance of the outcomes or actions you take to reject or deny those outcomes. However, in all of this process, all our lives, we end up in an infinite loop, chasing those variables that are endless or limitless. There is nothing wrong in being in the chase. The problems arise when we face the outcomes we dislike and we give up on the chase. We take abrupt turns, reversals or make a permanent stop at nowhere. This is not only hurtful for our mental & physical wellness, but also for those who depend upon us.

Values like peace, salvation, satisfaction, calmness, et cetera are just different forms of staying content. Therefore, valuing it is also important. It gives finality to your last action so that your next action gets more clarity and stays free of distortions. In conclusion, the concept of salvation described in several religions can be achieved in our lives through content. Staying Content is a form of immediate salvation for our experiences.

Importance of Sacrifice

Apart from all the above, there is another value, which supports the humanity as a whole. This value is so essential that without this, core values of humanity humanity cannot exist in totality and no association of humans, whether a family or a nation can exist. This value is Sacrifice. Whenever we wish to apply the above mentioned four personal values on someone else, we need sacrifice. Sacrifice is a value which extends personal values on to others or a group of persons. Help, cooperation, support, charity, love, care and other such values applied on a group or association of beings, are derivatives of sacrifice. We will discuss sacrifice later in our blogs through various discussions and example.

Understanding the concept

All the values, as discussed are abstract, subjective and interdependent. But, as per our understanding of the humanity, forms the core values for humanity. As humans, we have formed humanity and we are a part of it. Without caring for humanity, we can’t care for ourselves.

As a matter of fact, all philosophical values on which humanity relies, are dependent on other values and the chain continues till it comes back to the original value or reaches at some unknown. Therefore, no matter how much we try to explain, there always stays scope to explain things and further reason on it.

We have tried to be concise, in this endless endeavor. We cannot be precise, as these core values of humanity are not measurable by some form of metrics. However, we will aim to discuss more & more values, variables and ideas ahead, with lots of examples, of course, at the authority of our Karma.